Rethinking Provider Financing: Why Traditional Options Fail in Healthcare

The healthcare financing landscape is broken. Hospitals and health systems are trapped in a cycle of expensive capital access that drains resources from patient care and threatens operational sustainability. Capital Pulse fundamentally rethinks how healthcare providers access the capital they've already earned.

Let's examine the current state of healthcare financing, and why the industry desperately needs a better path forward.

The Factoring Trap: Usurious and Outdated

When healthcare providers face cash flow gaps, a subset turn to factoring — selling their receivables at a discount for immediate cash. It's a solution born of desperation, and it shows in the economics.

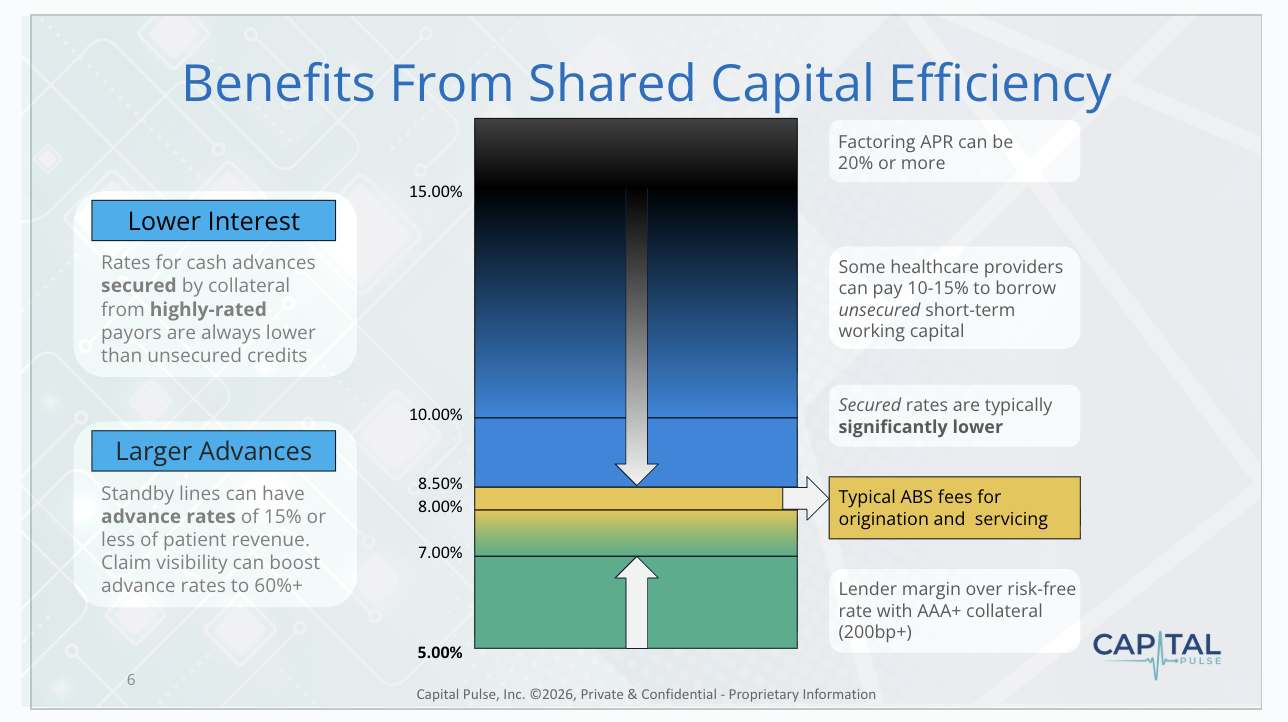

Traditional factoring arrangements carry usurious fees that drive borrowing costs well into double digits. This is margin erosion disguised as financing. Every dollar paid to a factor could have funded staffing, equipment, or patient programs.

Why do providers accept such punitive terms? Because traditional lenders fundamentally misunderstand healthcare receivables. They view all payers — individuals, private insurers, Medicare and Medicaid — with varying skepticism, unable to accurately assess their true value. This knowledge gap forces some providers into the arms of factoring companies, who charge exorbitant fees to compensate for their lack of insight into a receivable’s true value.

The verdict: Factoring is a symptom of a broken system. We can do better than this.

Lines of Credit: The Cash on Hand Paradox

Traditional lines of credit reveal a different dysfunction in healthcare working capital management.

Here's the paradox: Because providers can't predict cash flow with precision (receivables from third party payers can take 14-90 days or longer), they're forced to either hoard cash or maintain expensive credit lines. When payment delays occur, they draw on these lines at troublingly high rates — sometimes emergency penalty rates — just to cover payroll.

The root problem remains: traditional lenders cannot accurately value medical receivables. Because lenders view these assets as high-risk despite third party payers having high credit quality, they offer less favorable terms and elevated rates. The hospital's balance sheet becomes the pricing basis, rather than the actual payer's creditworthiness — the federal government or major insurers.

This creates a vicious cycle. Weaker balance sheets mean higher capital costs, which further weaken financial position, leading to worse borrowing terms. It's a stopgap that traps providers in escalating debt.

Bonds: A Winner-Takes-All System Failing Healthcare Equity

Healthcare revenue bonds represent a more sophisticated vehicle, but the current system is dangerously inequitable. Bond markets serve elite health systems — large academic centers and well-capitalized networks — while locking out community hospitals, rural providers, and safety-net institutions.

Institutions serving vulnerable populations face the highest capital costs when they can least afford them, while prestigious centers access favorable rates, cementing their advantage. The irony: hospitals serving the most financially precarious patients are deemed too risky to finance affordably: a self-fulfilling prophecy. As bond financing is largely unavailable to them, these facilities cut services and struggle to survive. Some close entirely.

Channeling low-cost capital exclusively to elite institutions accelerates healthcare concentration in wealthy areas. The social cost is measured in emergency room closures, longer ambulance transport times, and preventable deaths in underserved communities.

Rating Receivables, Not Institutions

Here's where technology changes things.

Traditional bonds rate the institution: balance sheet, market position, operating history. This favors large systems and penalizes smaller providers regardless of revenue stream quality.

Capital Pulse technology allows lenders to generate deep insights into providers’ third party claim values; thereby enabling lenders to rate the receivables portfolio, not the provider.

A rural hospital with 70% Medicare patient mix holds government-backed receivables — AAA credit risk, a quality similar to U.S. Treasury bonds. Yet traditional lenders price these as junk bonds because the hospital has a weak balance sheet. This reality is driven by the market’s inability to properly value future claims.

AI-driven predictive analytics close this gap. A Healthcare Claims Scoring System (HCSS) evaluates receivables on objective criteria: payer mix, claims quality, denial rates, reimbursement history. These metrics are quantifiable and directly predictive of payment likelihood and amount.

This democratization could transform healthcare access. Community hospitals could free up credit lines to fund expansion and modernization without drowning in debt service. The innovation isn't just financial engineering — it's using technology to reveal healthcare assets' true value and preserve care access where it's needed most.

Our Preferred Solution: Same-Day Reimbursement

Here's the fundamental question: Why should hospitals borrow money at high costs to cover revenue they've already earned?

The best "financing" isn't debt — it's immediate access to capital that's rightfully yours. Same-day payment mechanisms allow financial partners to advance funds for submitted claims within 24 hours, at rates lower than providers currently secure, because pricing reflects the receivables’ precise valuation, not the hospital's balance sheet.

This eliminates cash flow volatility, freeing finance teams to focus on strategy rather than crisis management. For a mid-sized hospital paying $300,000 annually in credit-card-level financing rates, the savings could fund multiple nursing positions, new equipment, or expanded clinic hours.

This is healthcare financing as it should be: efficient pricing based on actual, quantifiable high-credit quality risk, immediate access to earned revenue, and resources directed toward patient care.

A Call for Industry Transformation

The current system serves legacy financial institutions better than providers or patients. AI-driven analytics can fundamentally change this equation. When receivables are properly valued, providers gain more favorable financing terms. When providers receive same-day reimbursement, the working capital crisis begins to resolve.

The path forward requires rethinking healthcare financing from first principles — not as emergency measures, but as sophisticated, asset-based financing recognizing the intrinsic value of high quality, third party-backed revenue streams.

The opportunity is enormous. The need is urgent. The technology exists.

The question is whether the healthcare industry will demand better — because the technology now exists to meet that demand with innovation rather than inertia.

Capital Pulse uses AI-powered predictive analytics to help healthcare providers convert medical receivables into working capital. To learn how same-day reimbursement can transform your organization's cash flow, visit capitalpulse.com or contact our team.